Path to Peace of Mind

Experience the thoroughness in co-creating a plan duly aligned to your needs and goals

The content of your character is your choice. Day by day what you choose, what you think and what you do is who you become.

Value driven Wealth

Our approach to building wealth for you is based on the following principle

E= Mc²

Energy = Mass x Velocity of light².

This is Einstein's famous Relativity equation

From an investment perspective, we figured it out as below

E= Mc²

Earnings = Money x Character x Choice

- Earnings - It is the "wealth" created for you

- Money - Monetary investment made by you, managed by us

- Character - The value centric "character" of investment philosophy we follow

- Choice - The choice of investment assets we make

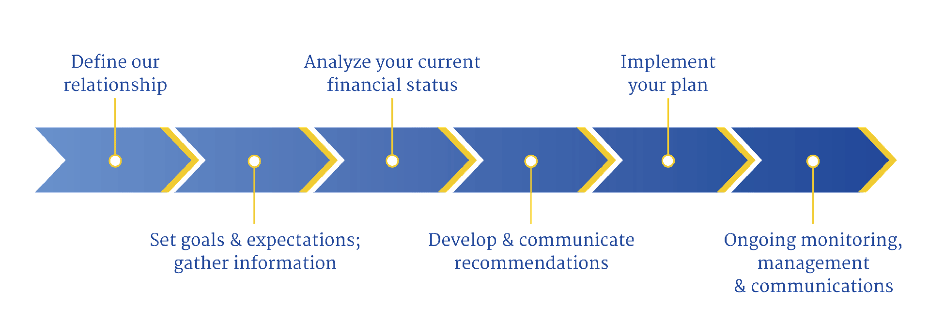

Engagement Approach

Engagement Approach

A financial planner is your partner through this journey and will work with you to achieve your goals.

The first step in this process is to understand responsibilities, plan accordingly and agree on how decisions will be made throughout the term of the partnership

In order to reach your goals and achieve your personal ambitions, you need to know where you are today and where you want to be in the future. You need to have a starting point and an ending point, the time frame and an estimated cost.

Your list of future goals needs to be small actionable list of items say about 4 to 6 at best.

Once you have your "family's goal list" identified, you can begin converting your dreams into financial goals by making them specific and measurable with a date and price. Remember to prioritize goals depending on your current stage of life

You should carefully review the legal statements and other conditions of use of any website which you access through a link from this Website. Your linking to any other off-site pages or other websites is at your own risk.

Based on your goals, we go step-by-step through a plan to help you understand each financial recommendation in order to make a clear decision. Listening and understanding your concerns is crucial to suggesting the right alternatives where required.

Once these recommendations have been implemented, we will be your coach to suitably coordinate with other trusted professionals such as: accountants, stockbrokers, attorneys, notaries or trust managers to ensure smooth implementation.

Life events and situations can change in the future, as a result ongoing monitoring is also crucial to achieving results and meeting financial goals. During this step, both you and the financial planner will assess, report, review and modify or adjust recommendations as required on a periodic basis.

For Information Purpose

How we differ?

Traditional Brokerage Centered Model

- Agent / Broker / Company Salesman pushing proprietary products

- Compensated largely on opaque commissions

- Narrow range of often overpriced, low-quality, in-house and monopolistic investment products

- Single entrenched vendor, often equals higher prices, poor service and frequent staff attrition

- Often beholden to corporate agenda, target driven

- Cutthroat, aggressive and push sales culture

- Shrinking sales model

Dhanayoga Engagement Centered Model

- Providing trustworthy, professional and prompt guidance

- Compensated predominantly on transparent payout

- Wide variety of competitively-priced, high-quality, third-party investment options across multi-asset classes

- Multiple competing providers often equals lower prices

- Independent-minded, client centered

- Collaborative culture, customized to your family's specific needs

- Growing partnering model